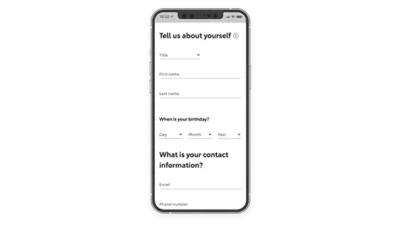

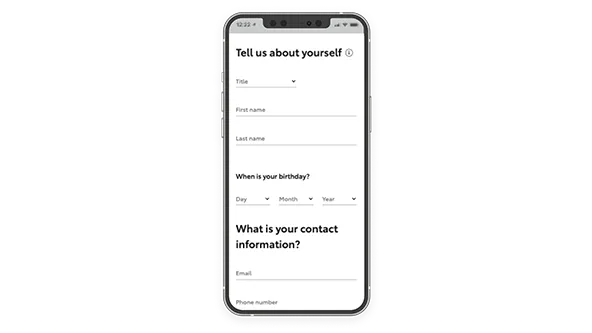

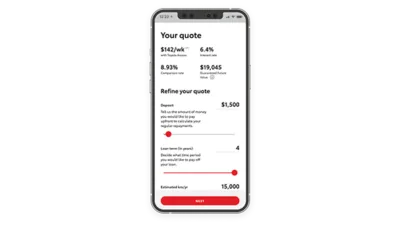

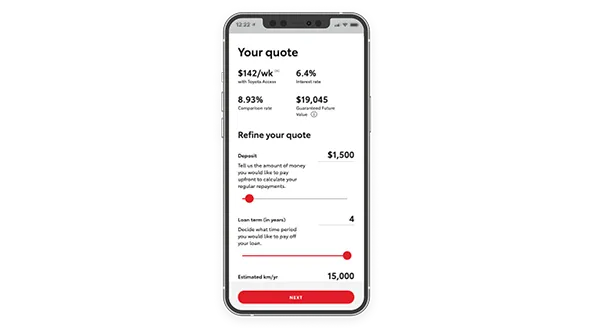

Make financing your next Toyota simple, with Toyota Personalised Repayments[F6]. Using simple information you supply us, we calculate your interest rate, comparison rate and weekly repayments – tailored to your unique financial circumstances.

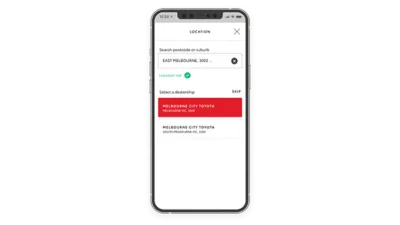

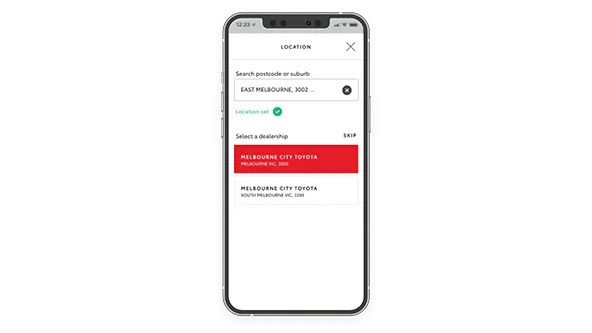

Take confidence knowing that no matter which Dealership you visit across Australia, you will get the same Toyota Personalised Repayments[F6] and interest rate. Once you have your personalised repayment, you can then compare vehicles across the entire Toyota range.

Make financing your next Toyota simple, with Toyota Personalised Repayments[F6]. Using simple information you supply us, we calculate your interest rate, comparison rate and weekly repayments – tailored to your unique financial circumstances.

Take confidence knowing that no matter which Dealership you visit across Australia, you will get the same Toyota Personalised Repayments[F6] and interest rate. Once you have your personalised repayment, you can then compare vehicles across the entire Toyota range.